Apple Pay and NFC2 min read

There is a new form of payment for iPhone 6 users, as Apple is joining a growing militia of banks and technologically – based companies that are all aiming to eventually wean the world away from all forms of cash payments. Owners of the iPhone 6 have no need to clutter their pockets, wallets and purses with bulky cash, in all its denominations, as their purchases of all kinds can simply be made by connecting their phones by touch with wireless readers. This revolutionary form of shopping is predicted by experts to forever change the way shopping is conducted, in much the same way that the music, mobile and personal computing industries have been forever changed. Apple Pay is the first to succeed along a path to eliminate cash payments that is strewn with remnants of other failed attempts by many of the best known names in banking and technology.

What Was Originally New (And Not so Long Ago) is Quickly Becoming Obsolete

In the realm of shopping, the way payments are processed is a huge business. Every day, in the United States alone, the prevalence of payments conducted by credit and debit is in excess of 12 billion dollars – meaning over 4 trillion dollars each year. The daily total then is around 200 million payment transactions every day, by credit and debit cards, and it’s time to pay attention to the growing antiquity of this process.

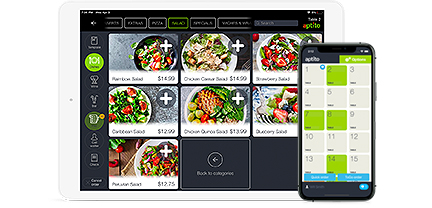

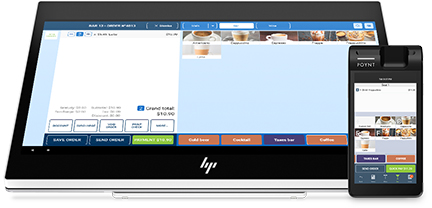

What Apple Pay Looks Like

Consumers can easily add a card by scanning it to their iPhone, and they thereby dispense with the need for the conventional pieces of plastic cluttering their wallets. The Find My iPhone app offers a deep level of security for users by immediately suspending all payments whenever a device is lost. Additionally, the amount that is actually spent on any given article will remain unknown to Apple, and during the entire time when the cashier handles the purchase, the user’s security code will remain unknown.

Developing Since 2009, and Now Ready for Use

Apple Pay is the name of this service, and its launch includes Amex, MasterCard and Visa, in addition to banks representing 83% of all credit card payments by volume. The merchants that consumers will find offering this service like Whole Foods Market, McDonald’s and the Disney Theme Parks will all have tills that are specially compatible. With this form of payment technology in place, expect to see the emergence of many apps for Apple pay using an API. In the UK, where Apple Pay has already taken off with great reception, most account holders already own touch to pay cards.